The implementation of GST has often been cited as a watershed moment in Indian fiscal history, with the state authorities often bringing to the forefront its various accomplishments with regard to improving the taxation structure and bringing about ease of business. However, amidst this show and pomp, an appellate tribunal for GST, which is a crucial step in the ladder of the GST-related disputed resolution process, has still not been set up after seven years of the GST Act being introduced, leaving litigants with several hurdles in seeking their sacrosanct right to judicial relief. After much anticipation, a reformed GST appellate tribunal (GSTAT) has been notified by the Ministry of Finance, bringing a sense of consolation to several litigants and tax practitioners. Further, on 29 December 2023, the Ministry notified that the GSTAT Principal Bench will be set up in New Delhi. However, this doesn’t serve as a panacea to all the problems, for on an earlier occasion, provisions relating to the constitution of such a Tribunal were stuck down by the Hon’ble Madras High Court in the case of Revenue Bar Association v. Union of India (RBA v. UOI) and the amended provisions too face the danger of the same fate with several legal luminaries raising objections to their validity. This article shall seek to highlight some prominent concerns about the constitution of the reformed GSTAT and attempt to provide its views regarding the optimization of the same.

A. Bench Strength and Composition

As per S.109(3) and S.109(9) of the CGST Act, 2017, the Benches of the GSTAT shall be composed of 3 members- namely, the president and two technical members, one each appointed by the state and center. The ruling in RBA v. UOI went on to state the composition of 3 judge benches with technical members outweighing judicial members as a ground for striking down Sections 109(3) and 109(9) of the CGST Act, 2017, placing reliance on the SC’s judgment in the case of R Gandhi v. UOI. The court took the view that as the maximum amount of cases before the GSTAT would concern disputes between the state-controlled assessing authority and the litigants, having benches where members appointed by the state can form a majority would seriously damage the judicial integrity of the tribunal.

To ensure compliance with the SC’s judgment in R Gandhi v. UOI, The Government, via The Finance Act, 2023, has amended Sections 109 and 110 of the CGST Act, 2017. The amended sections provide for a bench of 4 members composed of 2 judicial members and two technical members, one each for the center and state. The technical members will be appointed by the government on the recommendations of Search-Cum Selection Committee. To be eligible for appointment as a technical member (centre), a person should be or should have been a member of the Indian Revenue (Customs and Indirect Taxes) Service, Group A; or a member of the All-India Service with 3 years’ experience (at least) in the existing laws’ administration or of GST in the Central Government. The person should have completed at least twenty-five years of service in Group A. For appointment as a technical member (state), a person should be or should have been the State Government’s officer or an All-India Service officer not below the Additional Commissioner’s rank of VAT or the State GST. The person must have completed 25 years of service in Group A and at least have 3 years’ experience in the administration of existing law or GST or in the finance and taxation field in the State government.

Benches of larger sizes would eventually decrease efficiency, which is highly undesirable for a tribunal, especially the GSTAT, which faces a huge amount of pendency even before its formulation. While concerns may be raised that the guidelines for bench composition given in R Gandhi are limited in application to the NCLT and the NCLAT, the Madras High Court in RBA has clearly gone on to hold that the same would be equally applicable to the GSTAT too.

B. Selection-cum-search committees

S. 150 of the Finance Act, 2023, substitutes S. 110 of the CGST Act, 2017. S. 110 (4)(a) of the Amended CGST Act, 2017, deals with the composition of the Search Cum Selection Committee for Technical Members (State). The committee shall consist of the Chief Justice of the State’s High Court, the senior-most judicial member of the State (in absence, a retired High Court Judge), and three state secretaries (chief secretary, additional chief secretary, additional chief secretary of the concerned department). Similarly, S. 110 (4)(b) of the Amended CGST Act, 2017, deals with the composition of the Committee at the Central Level. The Chief Justice of the High Court and Supreme Court both act as President and Chairperson, respectively, in their concerned Committees.

However, certain issues arise with S. 110 (6) of the amended act, which requires the Search Committee to recommend a panel of two names, either for appointment or reappointment, for each post. With Supreme Court and High Court Chief Justices helming the search committees, one can only question why the recommendation made on the part of such a body has to be subject to scrutiny by the Executive when individuals holding such High Judicial offices are part of the process. Similar provisions as proposed under The Tribunal Reforms (Rationalization and Conditions of Service) Ordinance, 2021, were struck down by the judgment of The Supreme Court in Madras Bar Association v. Union of India (2021), where the court was of the opinion that such a provision would be detrimental to the interest of judicial independence.

C. Term Limit

The length of terms for members of the GSTAT has been a point of contention ever since the CGST Act 2017 was introduced. While the previous upper limit of 3 years has now been increased to 4, it still does not comply with the requirements as laid down in SP Sampath Kumar v. UOI and Roger Mathew v. South Indian Bank, which have gone on hold tenure of five years, as the minimum term length. The court in S.P. Sampath Kumar states that a mere five-year tenure may disincentivize well-qualified people to join the tribunal as they may be far off from reaching the prevailing age of retirement when they reach the end of their five-year tenure. For e.g., the President and every other member appointed to the National Company Law Tribunal has a five-year tenure, with a possibility for reappointment for another term of five years (S.413 (1) of the Companies Act, 2013).

With advocates having an experience of more than ten years in tax law seeking to be made members of the GSTAT by the way of CGST 2nd Amendment Bill, 2023, it is hard to comprehend why any lawyer having a quality practice would leave the commercial space to join as a member of the tribunal for such a short period of four years (with a maximum extension of two years). Reluctance on the part of these young and talented advocates to join would lead to judicial member positions being filled by retired judges who might not be able to add much-needed legal expertise and acumen in a field as complex as indirect taxation and GST. Also, security of tenure is much needed to ensure that members of the tribunal do not fall prey to any extraneous factors that might have an impact on their judicial work.

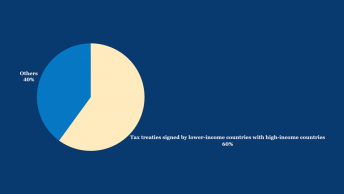

D. Questions of place of supply

The kind of tax that is to be levied is decided on the basis of place of supply. In case of inter-state supply (involvement of two states), it is IGST, if the supply is intra state (within same state), CGST and SGST is levied. The nature of supply is determined by the place of supply and location of the supplier. For the newly created GSTAT, issues of efficiency assume great significance. However, the new S. 109 (5), as amended by Finance Act 8 of 2023, might end up standing in the way of the same. Giving exclusive jurisdiction to the Principal Bench in New Delhi to hear cases related to the place of supply will lead to overburdening it with cases over a question that even the state benches can adjudicate upon in the regular course of their working. The initial S. 109 (5) of the CGST Act, 2017 had no such bar on issues related to the place of supply. No reason has been provided for the amendment of the section, and the current provision burdens the Principal Bench unnecessarily.

E. Conclusion

The GSTAT faces the burden of huge expectations on the part of all stakeholders of the fiscal system owing to the prolonged delay in its formation and the crucial responsibility it has been tasked with. With High Courts being burdened with GST-related appeals, its formation will ease up the docket and provide much-needed expertise needed to deal with complex legal issues.

While a huge part of the anomalies in its constitution that were flagged out in RBA v. UOI has been addressed by way of amendments, a lot still needs to be done. Bench sizes need to be reduced to 2 from 4, just like the NCLT and NCLAT, among other tribunals, to ensure faster delivery of justice. The recommendations as made by the Selection-cum-search committees shall be binding on the executive to ensure compliance with the judgement in Madras Bar Association v. Union of India (2021). Term limits need to be increased to a minimum duration of 5 years to adhere to guidelines as laid by the Supreme Court, among a lot of other issues that have been raised by eminent members of the bar, to ensure the creation of GSTAT that can serve its function well.

Editorial Note: This post was edited by Ishika Garg and Anuraag Bukkapatnam, and the infographics were made by Kshipra Shukla.