This series is aimed at examining the role of unjust taxation in triggering civil liberties movements across centuries and spanning different regions. This is the fourth piece in the series regarding taxation and civil liberties movements. This series was written by Apoorv, Pranav, Saranya, and Vinesh from the CTL.

Introduction

In the previous part of this series, we explored the historical underpinnings of tax resistance in American politics, tracing its roots to the American Revolution and its ongoing impact. Part IV of this series embarks on a journey across the Atlantic to examine the role of taxation in another pivotal historical event – the French Revolution.

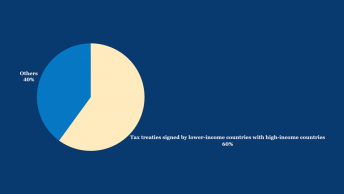

The French Revolution stands as a pivotal moment in political history, resonating far beyond its time and leaving a profound impact on various social movements, particularly in the realm of taxation. France’s escalating wars and bureaucratic growth led to exorbitant taxation, making it one of Europe’s highest-taxed states. The taxation process, conducted through intermediaries called “tax farmers,” resulted in widespread corruption and tax evasion, further straining the tax base.

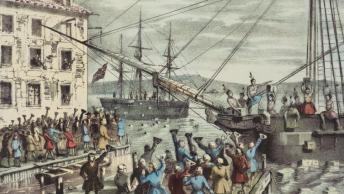

The storming of the Bastille, which ignited the French Revolution

The burden of these taxes disproportionately fell on the Third Estate—the common people—while the clergy and nobility enjoyed significant exemptions despite their substantial wealth. The ensuing injustice and impoverishment among the commoners eventually culminated in the outbreak of the French Revolution.

The fourth part of this series delves into the French taxation system, exploring various direct and indirect taxes imposed on the populace. It sheds light on the corrupt collection practices, which caused widespread resentment, leading to the demand for a fairer and more equitable taxation system.

Furthermore, we examine the revolutionary response to this oppressive taxation, as the French Revolution paved the way for significant changes in the country’s tax landscape. We’ll also explore the perspectives of prominent French philosophers, such as Locke, Voltaire, Hobbes, and Montesquieu, who provided profound insights into the legitimacy and nature of taxation during the Age of Enlightenment.

Join us on this enlightening journey to understand how taxation and civil liberties intertwined during this crucial historical period and how it shaped the evolution of tax systems and political ideologies that continue to impact societies to this day.

Taxation in the French State

The French taxation system was not just restricted to one type of direct tax but had multiple taxes levied on the common folk by different institutions. The “taille”, for instance, was a significant source of income derived exclusively from the common people. Clergy, nobles (except for some non-noble lands they held), state officers, military, professors, and certain cities such as Paris were excluded from such a tax burden. This direct tax originated in the middle ages and constituted 45% of all direct tax incomes. While the tax was meant to be applied depending on various measures of income and land wealth, the bureaucrats often applied this arbitrarily across districts resulting in an unequal distribution of burdens.

The capitation tax was the first to have a semblance of equality in theory, applicable to all social classes. However, the church, soon after the imposition of such a tax, was made exempt to such a tax on payment of an annual amount. Bureaucrats were exempt from the tax because of the office they held. And soon, much like taille, each community was just arbitrarily assigned a lump-sum to be paid and in effect, the burden of tax rested again on the people least able to shoulder it.

In 1710, the dixieme (one tenth of income) was replaced by the vingtieme (one twentieth of income). The vingtieme unlike the previous levies primarily came from landowners – noble and commoner- and was meant to be applied on income from industry, offices and land. Practically however, this was simply treated as an additional tax on top of the capitation tax already levied.

Apart from the state, the church extracted its own share of tax from the commoners and nobles—one tenth of their incomes had to be paid to the church (the “tithe”). The tithe included portions of grains, animal products, any yields of landowners, personal estates of clergy, etc.

Notwithstanding the host of direct taxation levied on common people, indirect taxes on products such as alcohol (aides), salt (gabelle) and tobacco (tabac) were levied. All royal subjects were generally subject to these taxes, although the nobility and clergy had limited exemptions from the aides and there were widespread exemptions from the gabelle, particularly for those with influence.

Collection of the Taxes

The Collecteur was a position that most people, the poor and the wealthy, feared. This invited widespread resentment from the broader populace. If the designated amount was not turned into the royal collector, the offenders were deemed personally responsible for the difference in amount. If they missed a payment, they would have to face imprisonment as well.

Local officials who collected the direct taxes would give the tax to Financial Receivers, who would then remit these amounts to the General Receivers, who are responsible for in turn giving these to the royal treasury. These officers were not members with an acute knowledge of finances, but had simply purchased their positions from the King in what was known as Venality, which had begun in 1500s to raise money for the state. If the King wanted to remove any of these officeholders, the purchase money had to be returned as well and therefore, these positions more or less became permanent. This was also a hereditary position which could be transferred from one generation to the other. Moreover, because the Financial Receivers were paid based on the quantum of sums they handled, it resulted in a system with loose controls and wide corruption.

Indirect taxes were collected by a group of private collectors known as Fermes Generales. The Fermes Generales paid the government a discounted fees in return for the right to collect, and kept a portion of taxes. This meant that the government earned a steady stream of revenue without expenditure on a bureaucratic structure to ensure prompt payment. The Fermes, in turn, while taking up the risk of collecting taxes, also benefitted if the collections exceeded the amount payable to the state. The most egregious form of this system was that the members of Fermes Generales were exempt from the gabelle, one of the most onerous taxes collected, and were further exempt from the direct taxes they earned on their employment. They were also not required to pay city levies and other obligations.

Cahiers de doleances

By the summer of 1788, there was an acute budget crisis. A rapidly expanding population had exceeded the available food resources. An extremely harsh winter in 1788 resulted in a famine that led to widespread hunger in rural areas. In Paris, escalating prices triggered protests and riots. The aristocracy during this period, refused to pay any more in taxes. By August, the King was told that the treasury was empty. Corrupt accounting systems made it impossible to know when the deficit had reached a point of no return. While there were attempts at reform to make public finance more coherent, they were temporary fixes which did not attempt to solve the underlying structural issues or were never really passed, getting stalled at the proposal stage. Pursuant to such a crisis, the King called for a meeting of the representatives of all three estates. It was through the meeting of the Estates General and on request by the King that the infamous Cahiers de doléances was drawn. The Cahiers de doléances was a list of grievances for all three estates, with extensive critique of governmental waste, indirect taxes, church tax and corruption. This became the precursor to the French revolution.

Comical depiction of the Third Estate carrying France’s tax burden

It is widely noted that an integral reason for the French Revolution was the excessive taxation of commoners, especially peasants who were unable to pay the tax at the costs of the clergy and nobility. Surprisingly, however, the Cahiers de doléances showed that it was not just the peasants but all three estates which found the taxes regressive. Additionally, in 1790, the tax committee of the new Constituent Assembly was so repulsed by the system of taxation that it not only recommended the creation of an entirely new tax system but suggested, in addition, that the very word for tax, impôt, “disappear from our language”.

In 1789, with the abolition of the French Monarchy, the French taxation system also came crumbling down. In August, amidst the French Revolution, the National Constituent Assembly issued 19 decrees, with the first one striking down a large part of the tax system. One of the provisions of the Declaration of the Rights of Man and Citizen, which was adopted on August 26, 1789, abolished the corrupt practices associated with judicial and municipal positions (Article VII). Another provision eliminated the privilege of certain individuals to pay fewer taxes, ensuring that taxes would be collected from all citizens and all types of property in a fair and uniform manner (Article IX). Article V specifically abolished tithes, while a decree issued on August 25, 1792, got rid of the remaining feudal dues, and a subsequent decree on July 17, 1793, abolished the rest. This latter decree also commanded the destruction of all feudal records.

Regarding taxation, Article XIII of the Declaration emphasized the importance of a shared financial contribution from citizens, which should be distributed equally based on their ability to pay. Article XIV affirmed the right of citizens to be informed about the necessity of public taxation, to consent to it freely, and to oversee its utilization, as well as to determine its proportion, basis, collection, and duration through their own representatives. Furthermore, Article XV asserted society’s right to hold all public officials accountable for their actions within the administration.

The National Constituent Assembly terminated the final tax farm lease on March 20, 1791, and in May 1794, 28 tax farmers were executed by guillotine. The Receivers General of Finance were abolished through a decree issued on November 14, 1790, but the process of settling the accounts of accountants, including the Receivers General, was lengthy and slow. In December 1792, they were instructed to surrender any remaining funds in their possession. Many of the accountants faced bankruptcy, while others chose to emigrate. For some, 1793 and 1794 were filled with nightmarish experiences of arrests, interrogations, confiscations, imprisonments, and guillotine executions.

Various taxes were abolished between 1790 and 1791, including aides, traites, octrois, gabelle, and tabac, along with several other taxes and fees. However, certain taxes like the gabelle and octroi were reinstated shortly afterward but later repealed again. From 1789 to 1793, the old direct taxes were mostly eliminated, and on March 18, 1793, a genuinely progressive taxation system was formally adopted, with only a few exceptions.

In 1788, the King approved reforms to improve the management and reporting of tax receipts and royal expenditures, which involved the elimination of many caisses (treasuries) and the transfer of their former responsibilities to the Royal Treasury. These reforms raised hopes for a system that better served the interests of the state. Among the changes, the King mandated that the Royal Treasury would oversee all receipts and expenses, implement double-entry bookkeeping for the caisse, and require a balance sheet three months after the end of each calendar year. Although these reforms were officially confirmed through a decree on March 30, 1791, it was only after 1815 that a modern public sector accounting system was gradually established to support the emerging nation.

Taxation in Napoleon’s Regime

Napoleon’s regime marks another shift of reforms to the French taxation system. During his regime, a system was established where prefects, appointed by the central government, were placed in charge of each department throughout the country. Additionally, sub-prefects were appointed to handle local affairs within their respective regions. These prefects possessed full authority over all aspects of life within their departments, effectively eradicating any remnants of local self-governance. Furthermore, a national police system was implemented, with centrally appointed police officials stationed in towns with populations exceeding 5,000 people. This allowed the state to exert greater control over civil society.

Philosophers and Taxation:

| Philosopher | Major Contributions |

| Locke | Since every individual benefit from public services guaranteed by governments, it is reasonable for them to contribute to tax that enables such protection. He emphasized the consent of taxpayer in enforcing taxes to align with the principle of protecting property rights |

| Voltaire | Emphasized the role of every citizen to national advancement, and therefore a responsibility to contribute to the state through tax. Underlying principle was the idea of tax as a bond with the nation. |

| Hobbes | Tax as essential for ensuring public safety. Since everyone benefitted from such a safeguard, everyone bore a burden to pay tax. Positivist notion that tax must be imposed as a command from the sovereign, with some principles such as equality being followed in such enforcement |

| Montesquieu | Taxes as an insurance premium, with taxes as proportionately linked to government and political liberty due to their role in ensuring security and peaceful enjoyment of livelihood. |

In the Age of Enlightenment, intellectuals offered profound insights into the nature and legitimacy of taxation, influencing political ideologies and shaping history, some of which have been explored below.

Locke

The crux of Locke’s ideas on taxation is evident in the Second Treatise, where he emphasizes that governments require significant funding, and it is reasonable for every individual benefiting from the protection offered by the government to contribute a portion of their wealth for its maintenance. However, crucially, this contribution must be given with one’s consent. Essentially, this consent is the consent of the majority, either given directly or through elected representatives. Without this consent, any attempt to impose taxes on the populace would violate the fundamental principles of property rights and undermine the purpose of government.

Further, according to Locke, the concepts of tax and property rights are inherently interconnected. Locke advocated for a single tax on landed income to restore the natural balance in society. He argued that if governments could reclaim the value added to commodities through land scarcity in the form of land taxes, the just exchange of valued goods produced by labour could be reinstated.

Voltaire

Voltaire emphasized the crucial role of all citizens in ensuring the prosperity of the nation, with the role of the ‘taxpayer’ standing as the most significant among them. According to him, every social class bore a responsibility to contribute its share to the state through taxation.

In Voltaire’s view, failing to pay taxes due to misfortune, personal greed, or religious interests resulted in an unfortunate consequence. These individuals suffered a material break in their bond with their nation. In essence, he underscored the importance of taxation as a means of collective responsibility and a way for citizens to actively partake in the well-being of society.

Hobbes

As per Hobbes, taxation is an essential aspect of any commonwealth, closely tied to security and the well-being of its citizens. For him, the importance of taxation lies in ensuring public safety and public revenue to support the payment of armed forces. Since all subjects benefit from the peace and protection provided by the commonwealth, they are all obligated to contribute through taxes. The specific amount of taxation required depends on circumstances, but it should be limited to maintaining civil peace and national security. In cases where the exercise of sovereign power threatens the safety and security of the citizens, they retain the natural right to resist and disobey commands.

Hobbes also believed that taxes must be imposed through laws; unless there is a command from the sovereign to pay tax, there is no obligation to do so. The sovereign is responsible for determining this obligation, and it should be codified and prescribed by law, i.e., a command.

Hobbes sets forth certain principles that the sovereign should follow in determining the tax burden. Among these principles, equality is a crucial one. Equal taxation is not only in the interest of public peace, but it is also aligned with natural law. Hobbes sees citizens’ contributions to the community as the price they pay to purchase peace. It logically follows that those who equally benefit from peace should bear an equal share of the burden, whether through monetary contributions or service to the commonwealth.

Hobbes acknowledges that people often object to taxes not solely because of the burden itself but due to perceived inequalities in its imposition. Therefore, he deems complaints justified when tax burdens are unevenly distributed.

Montesquieu

According to Montesquieu, the connection between taxes and political liberty is inseparable. He views taxes as a portion of each citizen’s goods given to the state in exchange for security and the peaceful enjoyment of the rest of their belongings. He equates the idea of taxes with an insurance premium. The amount of taxes paid by citizens is directly linked to the form of government and political liberty within the state. According to Montesquieu, citizens should contribute in proportion to their degree of liberty. Generally, as citizens enjoy greater liberty, the public revenue that can be collected increases.

He also emphasized the importance of determining the right balance, by exercising moderation and political prudence, between the needs of the state and those of the citizens. In terms of tax administration, Montesquieu favored tax collection by government officials over revenue farming, which tended to deplete the treasury and involved harsh methods.

Conclusion

In conclusion, the French Revolution stands as a pivotal moment in history that forever changed the course of political ideologies and the evolution of taxation systems. The excessive and unjust taxation imposed on the common people, while the privileged classes enjoyed exemptions, fueled widespread discontent and culminated in the outbreak of the revolution. Through the revolution, significant changes were made to the French taxation system, abolishing corrupt practices and ushering in a more equitable tax landscape. Furthermore, the perspectives of prominent French philosophers during the Age of Enlightenment shed light on the ethical and practical aspects of taxation. The impact of the French Revolution and the insights of these philosophers continue to resonate in modern societies, shaping discussions on taxation and civil liberties. Understanding this crucial historical period helps us recognize the significance of fair and just taxation as a cornerstone of democratic societies and the preservation of civil liberties.

Editorial note: The article was written based on the initial skeleton developed by Anuraag Bukkapatnam.