This series is aimed at examining the role of unjust taxation in triggering civil liberties movements across centuries and spanning different regions. This is the third piece in the series regarding taxation and civil liberties movements. This series was written by Apoorv, Pranav, Saranya, and Vinesh from the CTL.

Introduction

In the previous part of the series on Taxation and Civil Liberties, a historical account England’s taxation, exploring pivotal events like the Magna Carta and other tax revolts that influenced civil liberties was explained. In this third part, we shift our focus to America’s war for independence, and the role of taxation in shaping the nation’s birth and its influence in American politics today.

Much like how constitutionalism, representation, and taxation were an important part of British history, a similar account is also true of American colonies. In the latter half of the 18th century, a constitutional conflict emerged, sparking one of the most significant chapters in the history of both Britain and its American colonies – the question of Britain’s right to tax America. The resounding call of “no taxation without representation,” is an important event that marks the beginning of widespread discussions on the relationship between taxation and popular representation. In this part, we explore the role this played in America’s struggle for independence.

Representation and “Rotten Boroughs” in the Parliament

In the Glorious Revolution of 1688, the English Parliament had cemented its supremacy over the Crown and placed sovereignty in the House of Commons. Subsequent laws enacted in this period, such as those which restricted the monarch’s command of the army and entitlement to revenue to one year at a time, further limited the possibilities of the Crown ruling without the consent of the Parliament. However, there were multiple precedents for monarchs to bypass Parliamentary authority by manipulating the Commons. In the past, the Tudor and the Stuart monarchs had each given Parliamentary representation to a number of towns, not in the interest of making the Parliament a more representative body but to add members from areas in which the Kings’ men were politically dominant. However, unlike their predecessors, the Hanoverian monarchs were far less successful and far less invested in the idea of manipulating the Parliament themselves. Naturally, the task of manipulating the Commons was delegated to a body of ministers known as the “cabinet”.

The cabinet, dominated by Parliamentarians colloquially called the “old Whigs”, realized the need to use the same tactics as the Tudors and the Stuarts to buttress its numbers in the Commons. Thus, the old Whigs began using “rotten boroughs” to create and preserve a majority in the Parliament. “Rotten boroughs” referred to towns which had been granted representation in the Parliament in the past but had since lost much or all of their population to other, newer towns, such as Birmingham and Sheffield, which had yet to receive the right to send representatives. These boroughs sent representatives to the Parliament even though they had a disproportionately low number inhabitants (in one case, none), while newer and more populous towns did not. The old Whigs realized that gaining control over the representatives sent by rotten boroughs would help create and insulate their majority in the Commons and made effective use of this strategy.

The Doctrine of Virtual Representation

As the use of rotten boroughs became a political strategy and England evolved into an oligarchy, it became necessary to justify why such “rotten boroughs” continued to send representatives to Parliament while more populous towns did not. This was achieved by arguing that the Parliament was a unitary entity, meaning that every town in England was represented “virtually” by every single member of the Parliament regardless of whether it actually sent representatives to the Commons. This idea was called the Doctrine of Virtual Representation. The most obvious and necessary implication of this idea was that if towns which sent no representatives to the Commons were still bound by the will of the Parliament, the lack of direct and particular representation of a person, town, or entity in the Parliament did not limit the latter’s authority over it.

The ruins of Old Sarum (above). Old Sarum used to be a thriving medieval city, but has been deserted ever since. However, in spite of being an uninhabited ruin, Old Sarum continued to send representatives to the Commons till 1832.

The Doctrine of Virtual Representation was vociferously opposed in the Commons, and was already at the forefront of a heated political debate in England when the American colonies started showing discontent against English taxation. The old Whigs, determined to preserve their control over the Commons, and George III, hopeful of ruling with greater absolutism, made competing attempts to gain control over the rotten boroughs. However, these were opposed in the Parliament by the new Whigs, who advocated for the redistribution of seats in the Commons and the restoration of the Parliament’s status as a truly representative body. Though the debate around virtual representation had its origins in English politics, the debate would see itself played out not in England but in the thirteen English colonies in America. Figuratively and literally, the English colonies in America served as the battleground on which the conflict around tax and representation would be fought.

The Colonial Rebuttal: The Stamp Act and the Argument for Representative Taxation

The colonists’ case against English taxation was rooted in America’s unique experience with self-governance. The colonies had little experience of continental wars and monarchs trying to subvert the Parliament. Naturally, colonial institutions, such as assemblies, developed a more representative character. The absence of institutions like the Crown imposing its will on representative bodies was aided by England’s policy of “salutary neglect” towards its colonies, which allowed the latter to shape their economic policies substantially. The colonists, thus, developed a stronger sense of representative governance, at the heart of which lay the imposition of taxes. This development was reflected in the history of the thirteen colonies; on one occasion, the Virginia Governor’s Council and the House of Burgesses “thrust out” the King’s Governor, Sir John Harvey, for not transferring the Virginia Assembly’s proposals to the King. Other instances include the village of Watertown in Massachusetts refusing to pay taxes on account of not being represented in the assembly. This tradition set the colonies and colonists starkly apart and paved the way for a conflict between the two.

With the British Empire’s debts expanding rapidly due to the Seven Years’ War (a substantial part of which was spent defending the American colonies) the sentiment in London was to collect greater revenue from the colonies. Consequently, Prime Minister George Grenville enacted bills which sourced greater revenue from the colonies, including the Stamp Act of 1765. The Stamp Act of 1765 imposed a direct tax on the colonists, to be paid in British currency on the purchase of all official documents, newspapers, cards, etc. The colonists recognized the impact of this Act and responded with fierce opposition. The political front of the agitation against the Stamp Act saw the Sons of Liberty destroy stamps and harass stamp officials. On the other hand, the legal front of the agitation saw a renewed debate around representation, since the colonies neither had any representation in the Parliament nor had given their consent to the Stamp Act. Specifically, for the very first time, the colonists presented an opposition to the idea of virtual representation. The colonists argued that on account of their inherent rights as Englishmen and the colonies’ unique history with respect to direct taxation, the Parliament could not have enacted the stamp duties without representation from the colonies.

The idea of No Taxation without Representation was thus mooted for the very first time in the context of Britain’s relations with its colonies. On a deeper analysis, one finds that the colonists’ opposition to the doctrine of virtual representation presented an idea of bifurcated sovereignty: while the Parliament, as the supreme political authority in the British Empire, could legislate on general matters for the colonies, the imposition of direct taxes would require their consent. Thus, the Parliament had a lower level of sovereignty when it came to imposing taxes on the colonies.

While the colonists centred their argument on the “inherent right” of freeborn English subjects to be taxed with their consent, the British government based its rebuttal on an idea which was equally grounded in English law by that time: the doctrine of virtual representation. The underlying idea behind the British government’s position, which was subsequently articulated a decade later by Dr Samuel Johnson in Taxation No Tyranny: An Answer to the Resolutions and Address of the American Congress, was that the American colonies were represented in the British Parliament in just the same way as were all Englishmen at large, even those who did not vote or belonged to towns which were not apportioned any seats in the Parliament. This was because the Parliament, per the government, “was not a congress of ambassadors from different and hostile interests, [but was] a deliberative assembly of one nation, with one interest, that of the whole-where not local purposes, not local prejudices, ought to guide, but the general good, resulting from the general reason of the whole….[You] choose a member, indeed; but when you have chosen him, he is not member of Bristol, but he is a member of Parliament” All Englishmen, irrespective of their rank, property, or region, were, fundamentally “a single people with a definable interest”, and the Parliament “[was] the full and complete embodiment of the people”. Consequently, the Parliament was justified in legislating for the colonies even in the absence of representatives from the colonies. Additionally, the British government strongly rebutted all American attempts at carving a distinction between the Parliament’s power to legislate generally and its power to impose taxes. They argued that the Parliament was the supreme and absolute political authority in the Empire, which either had “all authority to make laws, or none”.

The enactment of the stamp duties and the British government’s subsequent invocation of the doctrine of virtual representation invited heavy criticism on both sides of the Atlantic. “The Great Commoner”, William Pitt the Elder, defended the rights of the colonists in the Parliament and famously derided virtual representation as “…the most contemptible idea that ever entered into the head of a man”.Across the Atlantic, the protests were even stronger. Localised picketing of stamp offices turned into a much larger resistance against the Stamp Act. Eventually, faced with the threat of an open rebellion, the Grenville ministry capitulated and repealed the Stamp Act, which brought with it a sense of calm to the colonies. For the remainder of the British rule in the thirteen colonies, direct tax was never imposed on the colonists by the Parliament without their consent. However, the repeal was accompanied by a Parliamentary Declaration that the Parliament indeed “had hath, and of right ought to have, full power and authority to make laws and statutes of sufficient force and validity to bind the colonies and people of America … in all cases whatsoever”.

The Tea Act and the “Death” of Virtual Representation

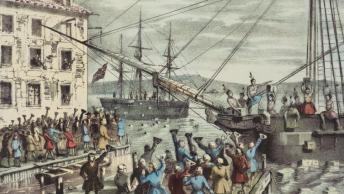

With the repeal of the Stamp Act, the debate around the representation of the colonies in the Parliament slowly cooled down, but only to resurface a decade later with the passage of the Tea Act of 1773. The Tea Act was a part of the Townshend Acts, enacted on the proposal of Charles Townshend, which imposed import duties on goods into America. The Tea Act provided the East India Company with an exclusive monopoly for importation of tea in the American colonies, and also decreased the import tariffs for the same. This enabled the Company to undercut the prices offered by American colonists, who used to sell cheap, smuggled Dutch tea. The colonists saw the continuation of the Tea Act not only as one detrimental to their mercantile interests but also as a means to force them to accept the Parliament’s authority to tax them without representation- only indirectly on this occasion. Unsurprisingly, the Tea Act was met with vociferous opposition. The infamous Boston Tea Party took place in response to the Tea Act, in which the Sons of Liberty, dressed as Natives, boarded the ships docked in the Boston harbour and threw chests of British tea into the sea. The British government reacted aggressively, anchoring through the Parliament a series of “Intolerable” Acts, which sought to punish Massachusetts for the Boston Tea Party.

As the political opposition to the Tea Act and the Intolerable Acts grew, the British government harked back to the doctrine of virtual representation to defend these enactments. The colonists had observed in their opposition to the Stamp Act that virtual representation was a difficult argument to rebut. Even otherwise, as the colonists recognized, the direct representation of the colonies in the Parliament would not amount to much in effect. As Johnson had correctly observed, if all thirteen colonies were to be apportioned seats in the Commons, they would have sent, at the most, twenty-three members to the Parliament, which was half the number of the members sent by Scotland. Recognizing this, the colonists sought not to challenge the idea of virtual representation per se but the very idea that colonies had adequate virtual representation in the Parliament. As Thomas Paine explained in his anonymously published Common Sense, the colonists had accepted the contention that the Parliament could legislate for those virtually represented in the Commons. However, they argued that because of the physical and experiential distance between the colonies and Britain, there was no “overriding harmony of interest that made Englishmen on both sides of the Atlantic one common people.” The Commons, thus, being unable to embody the interests of the colonies, could never virtually represent them.

The Boston Tea Party, 1773.

The argument that the Parliament could never even virtually represent the interests of the colonies was significant since it struck at the heart of the Anglo-Saxon idea of indivisible sovereignty. The logical consequence was that the Parliament was not sovereign to make any laws for the colonies. To the British, it signalled treason, while for the Americans, it was a call for independence.

Taxation and Representation in the Post-Independence Era

As explored in the preceding paragraphs, the colonies’ struggle for independence was based on the idea that taxation, as a right, was only vested in authority which had popular legitimacy. A natural corollary to this idea, which the colonists used to challenge the Parliament’s authority, was that unjust taxes could become a ground for challenging legitimacy. The entwinement of political legitimacy with taxation, which won America its independence, also had an impact on its future polity. As the new republic realized, tax resistance had become an important part of the larger “American” identity. For citizens of the new-born United States of America, resisting taxation had become just as much a matter of rights as it was a matter of heritage. In fact, even the post-Independence history of the United States is replete with examples of rebellions and political movements which aimed at tax resistance.

In the early years of the republic, there were three notable rebellions which were fought in opposition to the imposition of taxes. The first, the Shays’ Rebellion, began in 1786 when the new government imposed heavy taxes to finance the debts incurred during the Revolutionary War. These taxes were met with opposition from farmers and small traders, who started localized and peaceful protests to prevent enforcement agencies from foreclosing their properties. The protests eventually turned violent, culminating in a failed attack on a federal ammunition depot. Though the response of the federal government was not too harsh, keeping in mind the volatile state of affairs (with Thomas Jefferson famously quipping that “a little rebellion now and then is a good thing, and as necessary in the political world as storms in the physical”), the Shays’ Rebellion was an important factor in demonstrating the inefficiencies of the Articles of Confederation and persuading the states to adopt to the Constitution.

President George Washington personally leading the militias to quell the Whiskey Rebellion.

The Shays’ Rebellion was followed, half a decade later, by the Whiskey Rebellion of 1791. To finally retire the debts incurred in the Revolutionary War, the Washington administration-imposed excise duties on whiskey. The conflict erupted when a U.S. Marshall served warrants to seventy-five people at once for failing to pay the whiskey tax. Enraged, the protesters fired at the tax collectors, sparking a conflict. The death of a veteran of the Revolutionary War in the violence further intensified the rebellion, sparking fears that it might turn into a civil war. The Whiskey Rebellion was ultimately only quelled when Washington called the militias and personally rode at the head of the army to diffuse the situation. As with the Shay’s Rebellion, the Whiskey Rebellion also had a profound effect on American politics since it served as a test of the President’s policing powers under the new Constitution. The third and the last tax rebellion to take place was the Fries’ Rebellion, in which the taxes imposed by the federal government for an expected war with France were opposed. In a fashion reminiscent of the Revolutionary War, protesters engaged in public debates and meetings to criticize the tax and send petitions to President John Adams. The protests eventually turned violent, with protesters assaulting tax collectors and marching in hundreds to free the prisoners jailed for not paying the tax. Given its chronological proximity to the Whiskey Rebellion, the federal government, fearing that it would turn into a national event, called up the militias. However, as with the previous two rebellions, the convicts were pardoned by the President to diffuse the conflict.

The Gadsden Flag, which is commonly associated with the modern libertarian movement. It was created during the Revolutionary War in America to symbolize the colonies’ resistance to the British.

The culture of tax resistance in the United States did not only give rise to sporadic rebellions but also to prolonged political movements campaigning against taxation, such as the Libertarian Movement. The modern libertarian movement in the United States traces its origins to John Locke’s theory of social contract and classical English liberalism, which posit that political authority flows not from a king’s divine right but the consent of the governed, who share a contract with each other. Accordingly, for the libertarians, the “end of the state is to protect liberty and property, as these conceptions are understood independent of and prior to the formation of any state”. As Robert Nozick argues, individuals in the Lockean state of nature “join in society with others for the mutual preservation of their lives, liberty, and estates”, which becomes the sole legitimate purpose of a “minimal” state. Unsurprisingly, the libertarian conception of just taxation is extremely limited; taxation is just only when each individual is taxed in proportion to the benefits that it receives from the minimal state. As is evident, the inspirations for the Libertarian Movement are reflected in the foundational ideas of America’s independence, such as governance by consent and opposition to unjust taxation. The libertarian movement is also heavily inspired by some of the republic’s foundational texts, such as the Declaration of Independence, which lays down that the preservation of “life, liberty, and property” are inalienable rights which inhere in all individuals.

Conclusion

In conclusion, this piece examined the pivotal role of taxation in shaping America’s history, politics, and identity. The call for “no taxation without representation” during the struggle for independence shaped the nation’s identity and values of liberty and self-determination. From rebellions like the Whiskey Rebellion to the Libertarian Movement, tax resistance became part of the American heritage. Today, as nations forward, the lessons of the past remind us to safeguard civil liberties and ensure just taxation. America’s journey is a testament to the enduring spirit of freedom and governance by consent.

Editorial note: The article was written based on the initial skeleton developed by Anuraag Bukkapatnam.