This series is aimed at examining the role of unjust taxation in triggering civil liberties movements across centuries and spanning different regions. This is the second piece in the series regarding taxation and civil liberties movements. This series was written by Apoorv, Pranav, Saranya, and Vinesh from the CTL.

Introduction

In the previous part of this series on Taxation and Civil Liberties, we explored the profound relationship between taxation and civil liberties, witnessing how tax resistance ignited significant historical movements. In this part, we delve into pivotal events from England’s past, such as the creation of the Magna Carta and tax revolts, which have deeply influenced the nation’s trajectory.

England’s history weaves a tapestry of moments where the struggle for civil liberties and the burden of taxation became inseparable. The Magna Carta, dating back to 1215, stands as a cornerstone in the development of constitutional rights, addressing concerns about oppressive taxation by limiting arbitrary levies on the populace. Other notable tax revolts, like the Peasants’ Revolt of 1381 and the 17th-century English Civil War, left indelible marks, reshaping the balance of power and influencing civil liberties and tax laws.

Understanding these historical struggles and their impact on civil liberties provides valuable insights into contemporary challenges surrounding tax policy and individual rights. Join us in Part 2 as we journey through England’s tax revolts, seeking a deeper understanding of the delicate equilibrium between fiscal responsibilities and the preservation of fundamental rights and freedoms, guiding us towards a more just future.

Signing of the Magna Carta

The Magna Carta

The Magna Carta, also known as the Great Charter, emerged from negotiations between English noblemen and King John I at Runnymede, England, in 1215. This historical document, comprising a preamble and 63 clauses, continues to serve as a vital foundation for the rights asserted by English citizens, including those who immigrated to the United States.

While about a third of the text was eventually deleted or rewritten within the next ten years, the Magna Carta remains a document of seminal importance in British Constitutional History. A majority of the 63 clauses addressed grievances with respect to the rule of King John. However, a close reading reveals affirmation of certain fundamental values that did not only satisfy the political imperatives of the time but have also endured history. It established for the first time that everyone, including the King, was subject to the law. These core principles have found resonance in various constitutional documents worldwide, including the United States Bill of Rights (1791), the Universal Declaration of Human Rights (1948), and the European Convention on Human Rights (1950).

A Historical Background of the Magna Carta

In 1214, King John’s mercenary army suffered a significant defeat at the hands of the French during the Battle of Bouvines in northern France. The army’s funding through the tax known as ‘scutage‘, which substituted knights for military service, fueled dissatisfaction among the barons. Moreover, King John’s strained relationship with the Church further complicated matters which led to him surrendering his kingdom to the overlordship of the Pope in 1213 to resolve the situation. Later in 1213, a group of rebel barons, dissatisfied with King John’s rule, met with Archbishop Stephen Langton to express their concerns and demand the confirmation of the coronation charter, to rectify unjust customs, issued by King Henry I in 1100.

The dispute between King John and the barons further escalated in 1215 when many barons renounced their oaths of allegiance to King John and rallied behind Robert Fitz Walter as their leader. The pivotal moment in their campaign was the capture of London in May 1215.

Facing pressure after losing control of London, King John had no choice but to enter negotiations with the rebel barons. Both parties convened at Runnymede, a location on the River Thames near Windsor in the south of England, in June 1215. The barons outlined their demands in a document called the Articles of the Barons. Following extensive discussions with Archbishop Langton and clerics, King John granted the Charter of Liberties, famously known as the Magna Carta, on 15 June 1215.

Key Clauses of the Magna Carta and Their Enduring Influence

The Magna Carta provided a framework for regulating the relationship between the King and his subjects. The 1225 version of the Magna Carta, freely issued by King Henry III, expanded on the original text and became the definitive version. Today, out of the 63 clauses, only three remain in the statute books. One clause protects the rights and liberties of the English Church; another confirms the rights of London and other towns, and the third, the most renowned clause, grants free men the right to justice and a fair trial:

“No free man shall be seized or imprisoned, or stripped of his rights or possessions, or outlawed or exiled, or deprived of his standing in any other way, nor will we proceed with force against him, or send others to do so, except by the lawful judgement of his equals or by the law of the land. To no one will we sell, to no one deny or delay right or justice.”

While it provided essential rights, it was initially applicable only to a small portion of the medieval population known as ‘free men’. Unfree peasants, called ‘villeins’, were not entitled to the same privileges and had to seek justice through their lords’ courts. However, the adaptability of this clause allowed it to be reinterpreted for different purposes in various periods. In the 14th century, Parliament saw it as a guarantee for trial by jury. In the 17th century, Sir Edward Coke interpreted it as a declaration of individual liberty in his conflict with early Stuart kings. Such a nature of this clause has allowed it to be reinterpreted across generations, making Magna Carta a powerful symbol against the arbitrary use of power.

The other clauses of the Magna Carta addressed grievances with respect to land ownership, judiciary, and medieval taxes like scutage. One of Magna Carta’s key provisions was that no taxes, such as scutage and aid, could be imposed on the kingdom without the “common counsel” or general consent of the realm, represented by prominent barons and church officials. This restriction aimed to curb the arbitrary imposition of taxes by the monarch and ensure that financial decisions were made collectively, protecting the interests of the broader community.

Taxation During King John’s Reign

While the Magna Carta has been widely discussed as a foundation document for human rights and constitutional principles, some people have described it as a “financial peace treaty”. It consisted of approximately 63 clauses, with over 50 of them addressing contemporary fiscal grievances. These clauses reflected the widespread dissatisfaction with the Crown’s arbitrary methods of extracting money, appropriating goods, and infringing on financial rights, often resorting to coercive tactics.

King John faced chronic financial challenges during his reign, which began in 1189 after succeeding his brother, Richard I (“The Lionheart”). Richard’s costly ventures, including castle-building, leadership in the Third Crusade, and the ransom paid after his capture, had left England in a state of poverty. Moreover, the broader European landscape was undergoing a shift from domain-based states, where rulers relied solely on income from Crown lands, to tax-based systems.

Due to the insufficiency of Crown property in generating sufficient revenue, the transition to tax-based economies necessitated significant tax increases. King John explored various means to bolster income, often resorting to raising the rates of existing taxes. For instance, he imposed fines for violating strict forest laws that controlled the use of forest resources and restricted hunting and harvesting rights. Additionally, higher amounts were required from heirs to inherit their parent’s property, and individuals faced increased payments for marriage, rents from Crown lands (collected by local sheriffs under a tax farming system), and other levies.

To raise revenues, King John employed “extraordinary” collection measures reserved for specific needs such as funding wars. Among these measures were scutage, allowing knights to pay cash instead of providing military service, and taxes on movable property, including goods and livestock. What set John apart from his predecessors was the more frequent application of these extraordinary measures and higher rates.

Moreover, King John seemed to disregard customary procedures when imposing these taxes. For example, he occasionally skipped the usual administrative processes for scutage. Additionally, the raised funds were often utilized for purposes other than their stated intent, or the reasons behind the tax demands remained unclear. An example of this ambiguity was the tax on movable property in 1207.

If the barons’ assets could not generate sufficient income to meet the demanded sums, their assets themselves were seized instead. This not only allowed John to collect taxes but also deprived the individuals of their wealth and assets, which were vital sources of status, power, and prestige. Consequently, such actions gave rise to deep resentment among the barons.

Notably, John’s fiscal policies affected not only the barons but also the Church. During a dispute with the Pope over the appointment of the Archbishop of Canterbury, England faced virtual excommunication under a six-year papal Interdict. Taking advantage of the situation, King John seized Church property to further his financial interests.

It was with the advent of the Magna Carta that the concept of due process in taxation matters was more comprehensively established. The dissatisfaction arising from King John’s use of scutage is evident in Clause 12, which states that the tax should not be levied without the “common counsel of the kingdom”. Consequently, Clause 14 outlines the process for obtaining this common counsel, emphasizing proper summons to specified individuals at a designated venue with sufficient notice. These clauses clearly emphasize the need for due process in imposing taxes and a certain level of consent from those who were subjected to them, principles that remain relevant and crucial today.

Legacy of Magna Carta

The Magna Carta stands as a crucial cornerstone in British history, establishing principles that continue to hold significance today. Although Britain lacks a single written constitution like the U.S., the Magna Carta, along with later documents like the Petition of Right (1628) and English Bill of Rights (1689), remains revered by British citizens as a set of principles that the government must uphold, without violation.

Magna Carta’s Clause 29 laid the foundation for the due process clause in England’s uncodified Constitution. It barred the English government from imprisoning or punishing an individual without the lawful judgment of their peers and adherence to the law of the land. This clause remains fundamental to ensuring fair treatment and justice in legal proceedings.

The notion of “no taxation without representation” also played a vital role in America’s colonial days, inspiring the colonists to cite it in the Declaration of Independence and other documents that asserted their rights. The colonists viewed the charters issued by the King in a similar light to the Magna Carta, seeing them as safeguards for their rights. These protections found their way into state constitutions and were later incorporated into the U.S. Constitution and its Bill of Rights.

In the wake of the triumph over Britain, the United States set on to establish a constitution. However, just as the Magna Carta served as a check on the arbitrary exercise of power by a monarch, a need was felt for explicit limitations on the powers of the federal government. A series of amendments, collectively called as the Bill of Rights, enshrined crucial rights such as trial by jury, due process of law, and freedom from “cruel and unusual punishments.” These rights were considered the birthright of citizens of the new nation and were seen as principles dating back to Runnymede in 1215.

In the modern age, one of the most important legacies of Magna Carta is reflected in the modern human rights charters. The Universal Declaration of Human Rights, adopted by the United Nations in 1948, consciously echoes clauses from the Magna Carta, particularly those concerning freedom of movement, arbitrary arrest, and the right to a trial by jury. Eleanor Roosevelt, the committee chairperson, expressed the hope that the Universal Declaration would extend the promise of liberty embodied in the Magna Carta to people worldwide, serving as the “international Magna Carta of all men everywhere.” Similarly, the European Convention on Human Rights, echoes the famous Clause 29 of the 1225 Magna Carta, which prohibited punishment without the “lawful judgment of peers.”

The Peasants’ Revolt of 1381

The Peasants’ Revolt of 1381

The Peasants’ Revolt, also known as Wat Tyler’s Rebellion or the Great Rising, was a significant uprising that swept through England in 1381. Triggered by a series of socio-economic and political tensions, the revolt found its roots in the aftermath of the Black Death, the financial burdens of the Hundred Years’ War, and dissatisfaction with local leadership. Central to this rebellion was the resentment caused by the poll tax, which ultimately ignited the fury of the commoners against their feudal lords and led to a defining moment in the history of popular rebellion.

Following the devastating Black Death in the mid-1300s, England faced a severe labor shortage, leading agricultural workers to demand better treatment and higher wages from landlords. However, between 1377 and 1381, the government levied a series of poll taxes to finance its expenditures, adding to the commoners’ discontent. The heavy tax burden, combined with a deteriorating social structure, set the stage for a violent uprising in June 1381, known as the Peasants’ Revolt.

The Hundred Years’ War against France had severely depleted the Treasury coffers, compelling the government to seek alternative sources of revenue. The poll tax, initially aimed at relieving the barons from war-related taxes, was extended to cover both the urban and rural poor. As the tax rates increased with each iteration, its enforcement in 1381 proved to be the immediate trigger for the revolt.

In response to the trebled poll tax in 1381, peasants evaded payment on a massive scale, leading to a significant decrease in reported population numbers. The state responded by granting additional powers to tax investigators, assessors, and collectors. Evasion and falsification of inhabitant lists became common practices, intensifying the tension between the commoners and the state. In May 1381, resistance escalated as villagers in Brentwood drove out tax commissioners attempting to enforce the tax, indicating the mounting frustration and resistance to the burden of taxation. The harsh national taxation in the pre-revolt years and the severity of governmental exploitation of local communities were major contributors to the rebellion. The inequity of the tax system further fueled the peasants’ discontent.

While the Peasants’ Revolt did not achieve all its objectives, it had lasting effects on England’s social and labor landscape. In the aftermath of the rebellion, a new poll tax was introduced exclusively for landowners in 1382. By 1390, the attempt to regulate wages by law was abandoned, and the Statute of Laborers was effectively repealed.

The Window Tax

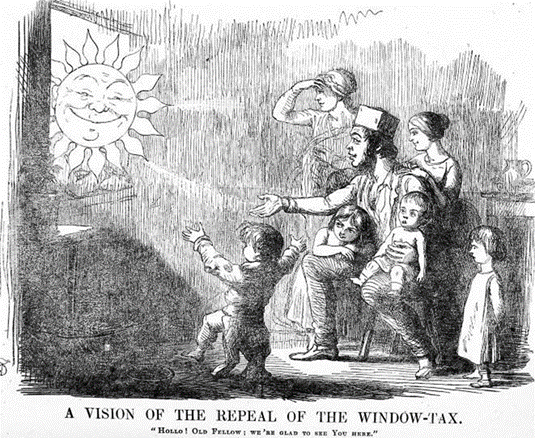

Family welcomes Sunlight as windows are unblocked on repeal of tax.

The window tax, introduced in 1696 in England, was designed to be a progressive tax, favoring houses with fewer windows, thereby reducing the tax burden on the rural poor. However, in urban areas, the tax had a detrimental impact on the working classes living in crowded tenements, leading to significant health and societal issues.

It aimed to raise funds for various expenses, including those arising from the Glorious Revolution, the war with France, and the re-coinage efforts undertaken due to the devaluation of existing coins caused by “clipping”. Initially, houses with fewer than ten windows were exempt from the window tax but subject to a 2-shilling house tax. Those with more than ten windows faced additional taxes, progressively increasing with the number of windows.

While the tax worked relatively well for the rural poor, it severely burdened the urban poor. In cities and towns, the working classes mostly lived in large tenement buildings, counted as single dwelling houses for tax purposes, leading to hefty window tax assessments. Consequently, the lack of windows in these crowded tenements created unhygienic and unhealthy living conditions, raising concerns about disease and public health.

An essential aspect of the window tax was that it was levied on the occupant, not the owner, making renters responsible for payment. Nevertheless, large tenement buildings posed an exception, with landlords bearing the tax liability. This led to landlords blocking up windows and constructing poorly ventilated tenements, exacerbating the living conditions of the urban poor.

Originally intended as a temporary levy, the window tax endured for over 150 years due to restructuring and increases. However, resistance to the tax grew over time as revenue declined due to blocked-up windows and reduced glass production in new houses despite population growth. The tax’s unpopularity led to a national campaign for its repeal, with medical professionals and advocates highlighting its adverse effects on public health. In April 1850, a motion to repeal the tax narrowly failed, but the public campaign gained momentum, ultimately leading to the repeal of the window tax in 1851.

Conclusion

In conclusion, Part II journeyed through England’s historical struggles, from the Magna Carta’s constitutional impact to the Peasants’ Revolt resisting oppressive taxes. These events underscore the delicate balance between taxation and the preservation of fundamental freedoms. The Magna Carta’s principles influenced American independence, while the window tax revealed the impact of taxation on the urban poor. Studying these events allow us to better navigate the complex interplay between taxation and civil liberties, guiding us towards a fairer future in balancing taxation with civil liberties.

Bibliography

Barker, Juliet. 1381: The Year of the Peasants’ Revolt. Harvard University Press, 2014. JSTOR, https://www.jstor.org/stable/j.ctt9qdsnf.

British Library. https://www.bl.uk/magna-carta/articles/magna-carta-in-context. Accessed 15 Sept. 2023.

Gillespie, David S. “The Black Death and the Peasants’ Revolt: A Reassessment.” Humboldt Journal of Social Relations, vol. 2, no. 2, 1975, pp. 4–13. JSTOR, https://www.jstor.org/stable/23262015.

Ideas. https://press.princeton.edu/ideas/taxing-the-light-of-heaven. Accessed 15 Sept. 2023.

Due Process of Law – Magna Carta: Muse and Mentor | Exhibitions – Library of Congress. 6 Nov. 2014, https://www.loc.gov/exhibits/magna-carta-muse-and-mentor/due-process-of-law.html.

Jane Frecknall-Hughes, The Conversation. “Why Magna Carta Was Fundamentally a Financial Peace Treaty.” Scroll.In, 14 June 2015, http://scroll.in/article/732025/why-magna-carta-was-fundamentally-a-financial-peace-treaty.

Magna Carta Project – Feature of the Month – The Rebel Seizure of London. https://magnacartaresearch.org/read/feature_of_the_month/May_2015_4. Accessed 15 Sept. 2023.

Oates, Wallace E., and Robert M. Schwab. “The Window Tax: A Case Study in Excess Burden.” Journal of Economic Perspectives, vol. 29, no. 1, Feb. 2015, pp. 163–80. www.aeaweb.org, https://doi.org/10.1257/jep.29.1.163.

No Taxation Without Representation – Magna Carta: Muse and Mentor | Exhibitions – Library of Congress. 6 Nov. 2014, https://www.loc.gov/exhibits/magna-carta-muse-and-mentor/no-taxation-without-representation.html.

Taxing the Light of Heaven. https://press.princeton.edu/ideas/taxing-the-light-of-heaven. Accessed 15 Sept. 2023.

Under Magna Carta the King Cannot Impose Taxes without the Approval of The. https://oll.libertyfund.org/quote/under-magna-carta-the-king-cannot-impose-taxes-without-the-approval-of-the-common-counsel-of-the-kingdom-1215. Accessed 15 Sept. 2023.

“Wat Tyler and the Peasants Revolt.” Historic UK, https://www.historic-uk.com/HistoryUK/HistoryofEngland/Wat-Tyler-the-Peasants-Revolt/. Accessed 15 Sept. 2023.

Editorial note: The article was written based on the initial skeleton developed by Anuraag Bukkapatnam.